About Us

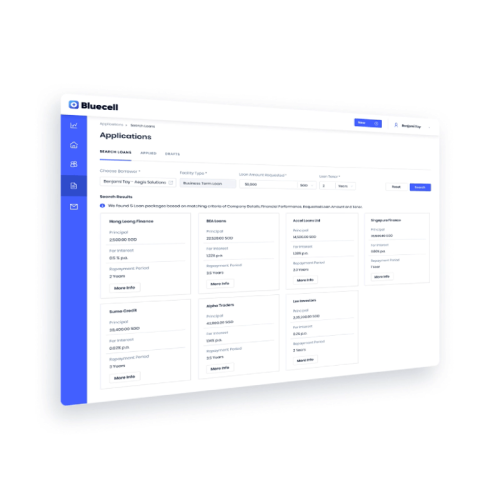

Bluecell intelligence (BCI) provides an integrated end-to-end solution for business owners, lenders, loan consultants and intermediaries in Singapore. We help SMEs acquire financing in their journey toward growth.

The lending ecosystem in Singapore is fragmented and lacks consolidated information. At BCI, we aggregate lender offers, supporting SMEs through a robust lending solution through data-driven intelligence. Our platform lets lenders, business owners, loan consultants and intermediaries streamline and automate operations.

Bluecell builds an inclusive environment, actively assisting SMEs in meeting their financial needs. We aid SMEs in reducing the cost and simplifying the process.

Start improving your lending experience today.

Vision

To deliver a streamlined lending experience for SMEs, financial institutions, loan consultants and intermediaries with data-driven intelligence.

Mission

Bluecell Intelligence is dedicated to consolidating Singapore’s fragmented lending ecosystem and bridging the supply-demand mismatch through a robust and accessible lending platform. Our mission is to support SMEs, financial institutions, loan consultants and intermediaries in making informed decisions based on insight and transparency.

Our Team

Vince Wang

CEO & Co-Founder

Vince has worked extensively in the Corporate Lending space with 10 years of experience in SME Banking, Commercial Banking and the Alternate Lending Market and have served a diverse clientele ranging from micro SMEs to Medium-sized Enterprises and Public Listed Companies.

He started his career with an award winning, Fortune 500 International Financial Institution to assist SMEs on their working capital requirement and later spearhead and manage two teams that serves the Consumer Banking and Business Banking segment. He has also worked closely with Product Managers and Credit Departments in pioneering the SME lending product by establishing the Process, Product Policies and Market Strategies.

By noticing a gap between what the Financial Institutions are willing to provide and what the businesses truly need, Vince founded One Financials & Investment Pte Ltd as a Supply Chain Financing Solution Provider to provide an alternative to traditional sources of funding.

Vincent He

Co-Founder

Vincent has 10 years of banking experience, specialising in the SME lending space. He joined the bank as a relationship manager for SME clients. After winning multiple accolades in his sales position, he was tasked to head the SME commercial mortgage and business loan teams. Due to the vast network and contacts he had built over the years, he took on a bigger role by taking on a Private Banker position at Standard Chartered Private Bank covering North Asia market.

With his speciality in loans and his vision of serving the “underserved” SME clients of the banks, he took a big leap into the private sector and built the team of Finex3 from scratch. From a simple private lending business which he set out to do, he has evolved the business into one which caters to funding requirements of differing complexity and created an investment arm which considers deals from a wide spectrum.