Trade Financing - Providing Solutions for your Business growth

The Trade Financing in Singapore is undergoing a digital transformation and moving towards the new trend of Fintech for more efficient ways of doing business.

The current situation and downtrend in the economy has caused a shortage of funds in the market. Covid-19’s impact will affect SMEs in many ways due to new opportunities and risks that arise in the financial markets. New challenges are faced everyday as there is uncertainty arising from different sectors in the industry.

Important facts about Trade Financing

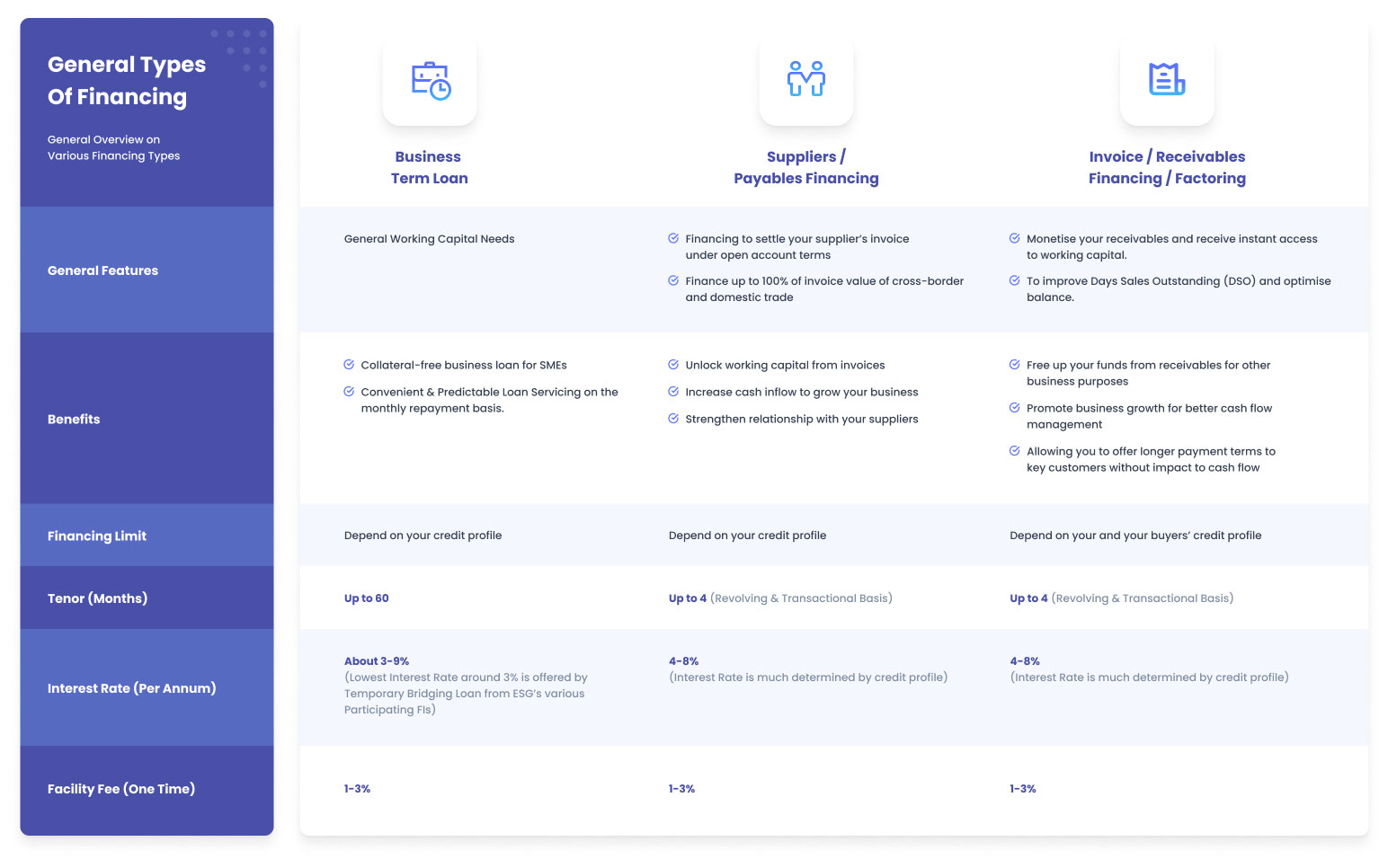

Trade financing provides buyers with a credit line to pay for the goods, and secures the payment of the goods for the seller. This helps to promote international trade and facilitate import, export activities. Trade Financing allows SMEs to access working capital to have liquidity for making investments, pay suppliers or other business expenses. It is a form of working capital finance which is used to bridge the funding gap till the time the borrower buys the stock for selling and waits to get the payment for it. There are many terms involved such as Export Finance, Import Finance or Inventory Finance, where the borrowers are at different stages in the supply chain. The lenders will fund the purchase of stock over a short period of repayment duration.

Trade Finance is a term used for financial transactions for both domestic as well as international trades. The financing transactions include lending, issuing letters of credit, factoring, export credit and insurance. Most of the world's trade depends on trade finance which involves many parties exchanging hands. One of the most difficult parts of Trade financing is the handling of large volumes of paperwork. Banks and financial institutions are trying to reduce the cost and increase efficiency by replacing the paperwork with digital transition.

The importance of Cash Flow

Cash flow can have the biggest impact on the success of your business. According to the Industry reports there is a huge gap between the Trade Finance available and the requirement worldwide. And almost half of the financing needs come from Asia. From these, most of the SMEs proposals are rejected. The reason behind this being that they are generally considered to be risky or due to the regulatory constraints. SMEs claim that a little help with Trade Financing loans can help them grow their business but they are tied up due to unavailability of funds. They are forced to take up personal loans to meet their needs, which is not the right solution !

As the global economy uncertainty sets in, it is natural that lenders and investors would look at new deals cautiously, preferring to secure their cash. For large suppliers and businesses this does not seem to be an issue as they get their liquidity from various sources and have a buffer of cash flow. But for smaller businesses, suppliers and SMEs it's a struggle to take over the payment terms without financing solutions. Their cash flow is limited, thus they need to have access to alternative financing to stabilise their cash flow.

Many new Fintech companies are emerging in the market for this reason, to provide solutions for the gap existing and the crunch being felt due to the shortfall of cash flow being provided by the lenders. This helps the small sized companies to have access to Trade Financing facilities.

How Trade Financing benefits your business

Companies of different scales might have different objectives and resources. They might have limited funds to allocate for digital transformations and may go for simple solutions. Instead of making huge investments immediately, they can approach the Bluecell platform and make use of the SME go digital initiative to analyse their needs and the funds available to them. These companies can procure loans from approved IT vendors at minimal costs and signup for free to join our portal.

Temporary Bridging Loans to get cash flow

As the name suggests Bridging loan is a short term loan suitable for temporary financing. These are the short term loans that are available for businesses who are in urgent need of money until expected funds are available. It can be applied for business capital finance when funds are needed for a short period of time for bridging the gap till their receivables are expected to come or if there is a delay in payment of funds from their customers. These are most suitable for the companies that face financial challenges in day to day work and can be used to take care of working capital while waiting for longer term financing. It helps to handle their liquidity requirements for immediate needs such as paying vendors and suppliers, or settling operational costs. Temporary bridging loans are a form of short term financing that businesses consider in urgent need of funds.

Is Bridging loan the right solution ?

Unexpected circumstances can come up anytime. With the current situation everything looks bleak and uncertain with many industries sustainability in future. This can contribute to losses or increase in expenses which are not accounted for. But the regular operations must still go on to keep the business running and functional. This calls for systematic planning and being prepared for such situations. Trade financing or bridging loans can help you through these unexpected situations.

Usually new businesses face problems at initial stages which are not accounted for. There can also be unforeseen circumstances where accidents or breakdowns can happen causing a halt and hindrance to your work leading to loss of funds. While waiting for longer term financing companies may have to arrange for basic expenses and payments to vendors. With the relatively fast approval for a bridging loan, you could ensure that your business gets the funds it needs to avoid any financial problems.

Future of Digital Trade Finance and Bridging Loans

The emergence of new technologies is bringing a transition in the industry leading to a new era of digital trade finance. Singapore being on the path to make it a tech savvy place is giving it a further boost. Many digital players are establishing and many are changing over from the traditional way of working to digital transformation. The recent months and current situation demands for this change and has accelerated the digital trend. This is reshaping the way of working and upcoming businesses are looking for financial services providers to meet their new, emerging changeovers.

This digital knowledge is helping to reduce the cost of trade finance transactions and increases the transparency for all parties involved. This also helps in extending the services to much larger markets at the same time along with offerings to many SMEs with wider range of facilities and lower turnover time.

How can Bluecell help you find solution

One of the biggest challenges that small businesses face is cash flow crunch. By using Trade financing facilities they can easily overcome such challenges. For instance, without trade financing credit facilities, a SME importer might have to wait till customers pay them before having enough funds to procure the next shipment from suppliers. Due to the constraints if the Trade financing is unavailable then the SMEs can go for other short term loans such as the Working Capital loan or the Temporary bridging loan. This helps the SMEs to plan their cash flow efficiently for running their business smoothly.

The new age of Fintech and Digital Finance can help to raise funds but most of the upcoming small businesses are unaware of the facilities available to them. For traditional bank loans, preparing extensive accounting documents is time consuming, which is not required when borrowing from the digital platforms. The Bluecell platform helps you to connect with many lenders at the same time. While applying manually different lenders may offer different interest rates, but on bluecell platform you can compare the interest rates being offered from all the available lenders and find a suitable lender to understand your business operations so that the loan can be customised towards your company’s needs. This facility along with fast approvals online can help you get approvals and process your funds much faster and at a much lower cost. Bluecell is a centralized digital end-to-end lending platform that connects SMEs financial institutions and consultants for the loan application process online.

Most banks will usually take between 2-3 weeks to process a loan application. The digital platform will help you reduce this time and get faster approvals and processing. As this is a new way of working through fintech companies many businesses are not aware of how the system works or they are not tech savvy. If you urgently require a fast business loan and you are new to the digital platform, you can consider engaging a SME loan consultant as well from our platform, to help with the application process. This can be made available to you from our pool of networks of consultants and intermediaries. This can help expedite the turnaround time and a smoother application process.

To connect or find out more contact us at https://bluecell.sg/contact-us/