Bluecell Launches Green & Sustainable Financing Initiative “Greener SMEs, Cleaner Future”

Bluecell pledges to support environmental and economic sustainable activities through “Green & Sustainable Finance”.

With a lot being talked about Climate change on a Global level and debates in various forums concerning adverse impact of climate change on our environment, we all need to play our part to minimize its effects on an individual as well as Corporate level. Bluecell takes the initiative to provide Green Financing for sustainable projects which works in accordance with the Singapore government's plans that have been rolled out to support Green loans and Sustainability-linked projects.

What is Green Loan ?

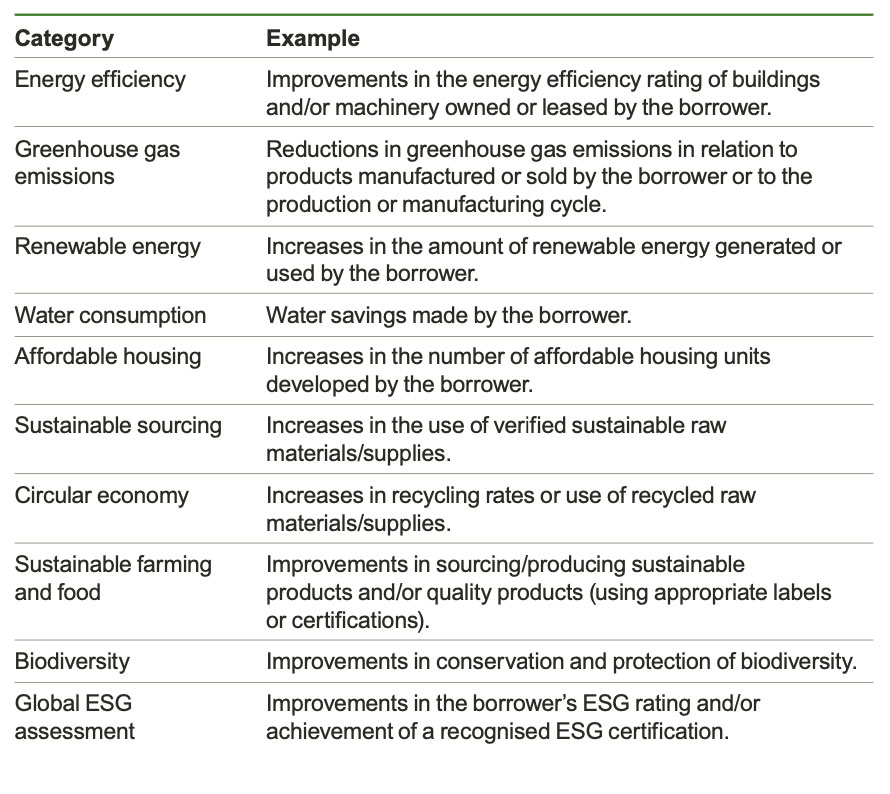

Green loans are the loans that are used for financing environmentally friendly projects which are called Green or Sustainable projects. To avail these loans, the companies have to fall within the approved categories and fulfill certain criteria laid down under Principles of Green Financing. Eligible projects may include efficient buildings, renewable energy, sustainable waste management and climate change adaptation.

Typical projects that fall under the green finance umbrella include :

Source: Principles of Green Financing

The borrowers are required to align their loans to certain guidelines and principles such as indicating :

- Use of proceeds

- Project evaluation and selection

- Management of proceeds

- Reporting

These loans should be used for green projects and should clearly outline the environmental benefits. Borrowers should indicate the environmental sustainability objectives of their projects along with how the projects fulfills the eligibility criteria and fits in the categories specified. Green loan funds should be put into a dedicated account, or tracked by the borrower to maintain transparency in the usage of proceeds. The information on use of proceeds should be updated for records and verifying its allocation.

Green loans are different from sustainability-linked loans. The Sustainability-linked loans are not required to be put towards green projects. Instead, they are usually tied to sustainability targets by lenders. If the targets are met the interest rates are reduced. There are no restrictions on the use of proceeds for sustainability-linked loans, they can be used for business operations and working capital purposes.

Benefits of Green Loans and Sustainable Projects

The Green loan projects can help to improve the image and goodwill of the company, hence increasing its competitiveness and standing against similar players in the market. Having sustainable-linked goals can help companies to reduce the costs and interest rates of loans which can help them grow their business. The funds can be put to use for other business requirements to help them financially.

- Be part of the force to combat climate change & the first mover to stay relevant.

- Financial inclusion and insurable.

- Projects or companies that embark on “green” tend to benefit from cost efficiencies in the long run.

- 9 in 10 investors would want their money to be invested for good causes.

- Consumers are inclined in supporting sustainable products.

Green Financing for MSMEs and SMEs

The Monetary Authority of Singapore (MAS) rolled out a new Green and Sustainability-Linked Loan Grant Scheme (GSLS), on Nov 24 2020 to help companies of all sizes get more support in securing green and sustainability-linked loans. MAS is now supporting smaller companies by defraying the expenses of engaging independent service providers to validate the green and sustainability credentials of the loan. The grant also encourages banks to develop green and sustainability-linked loan frameworks to make such financing more accessible to SMEs. The grant will help to channel more financing towards green projects and enhance companies sustainability practices. Through the frameworks set by banks and financial institutions for streamlining the process of lending, it will direct financing to activities that promote sustainable development in Singapore.

Further steps are being taken to promote green and sustainability-linked loans for SMEs. Simplified processes and clear standardised criteria are set out for borrowers. Small and medium enterprises can get finance to develop sustainable projects by utilising existing ‘green’ certifications. They can get existing certifications from Singapore industry authorities to certify the validity of specific green projects or assets, instead of the externally-reviewed Green Finance Frameworks used by corporates. This will reduce the time, complexity and cost associated with applying for green finance, providing SMEs an easier way for getting green financing. The certifications help determine the valid use of proceeds of a loan. This could include the purchase of greener equipment, development or production of sustainable or recycled products, construction or renovation of green buildings, or purchase of energy-efficient assets.

Bluecell’s Initiative

With the invaluable support from our partners and consultants in the Blockchain and IoT space, Bluecell aims to unlock greater value and business advantages for our Green and Sustainable SMEs and lenders.

Many banks and financial institutions are expected to participate in this project in the near future for community development and their contribution towards long term sustainability goals. Bluecell has also partnered with other similar organisations like Stacs to work in supporting Green financing. It also intends to partner with many other lenders on its platform to finance SMEs and small businesses for Green loans and sustainability-linked projects.

Most of the financing done under green loans through the well known banks are usually for the big corporates. It is due to the fact that it requires due diligence associated with the assessment of a loan’s use of proceeds. This involves cost and time associated with Frameworks regulations which has deterred SMEs to access green finance, preventing them from taking forward their ambitions to shift to greener business practices.

These factors impact the likelihood of adoption of ESG (Environmental, Social, and Governance) by smaller businesses and make it lower. But when large Corporates lean towards ESG, it is bound to flow to the smaller businesses that form a part of their supply chain. To exist in the ecosystem and to be relevant, they have to adopt the same. Bluecell aims for more inclusion of MSMEs and SMEs by making them aware about this new concept, vision and its benefits for the society as a whole and by extending the option of Green financing to them at attractive rates.

Bluecell along with its partners will help SMEs to get loans in the areas of emerging opportunities such as renewable energy and green buildings sectors, as well as other sectors that contribute to sustainable development. Bluecell and Stacs, two fintech firms have joined forces to use blockchain technology to support green and sustainability-linked loans. A key focus in this collaboration is effective management through GreenSTACS to provide green financing. As an aggregator of lenders, Bluecell can offer green and sustainability-linked loans through the platform from pro-green lenders at better-than-market terms.

Learn more - Bluecell Green Finance

Press Release for Bluecell and Stacs partnership